Articles

States, and therefore currently spend to simply help give Snap, could possibly get deal with difficult possibilities given those individuals large can cost you. That may is cutting dining assistance or any other condition advantages otherwise actually eliminating Snap altogether, Bergh told you. As well, the house package requires claims to pay for 5% to help you twenty-five% out of Snap dining benefits — a departure on the 100% government financing of these advantages for the first time regarding the program’s record, Bergh told you. Consequently, 20 million people would be overlooked of one’s benefits of the full man tax borrowing since their family members earn deficiencies in, Ruben told you. Family Republicans has advised enhancing the restrict boy income tax borrowing to help you $2,500 for every boy, up out of $2,000, a positive change who enter impact starting with income tax 12 months 2025 and you can end after 2028.

- It doesn’t matter if you possess an android os mobile phone mobile phone or an apple’s ios adaptation, you could manage this game from the efficiency of your home.

- To find out more, discover GST/HST See 265, GST/HST Registration to have Detailed Loan providers (Along with Chosen Detailed Loan providers), otherwise Publication RC4082, GST/HST Advice for Causes.

- To help you compute this matter, play with a copy away from federal Plan D (Mode 1040) because the a worksheet, plus the federal terms to have calculating financing development and you may loss only for deals which were from New york offer.

- For individuals who cause an excessive amount of damages for example gaps inside the structure or heavily stained carpet, you are recharged for these form of damages.

Better Banks to have Immigrants and you may United states Low-People

To learn more, find Book RC4082, GST/HST Advice to own Charities. Sponsor of a meeting mode the person who convenes the brand new seminar and you may offers admissions to they. Someone who aids a seminar because of financial or other support of one’s experience isn’t a recruit of one’s convention to possess GST/HST objectives. The company matter (BN) ‘s the fundamental identifier to possess enterprises that is novel to each organization. It’s in addition to system accounts that are used for specific company points that needs to be said on the CRA. A business needed to check in within the simplified GST/HST could possibly get, when it matches particular conditions, willingly affect sign up for typical GST/HST.

GST/HST registrants fundamentally don’t allege type in income tax credit to recover the newest GST/HST repaid or payable for the assets and you can features obtained making excused offers. Immediately after the category features a rating away from no to help you five, we become the fresh weighted mediocre to determine the superstar get away from a bank checking account. We weigh certain categories, such as interest rates, far more heavily than the others, including minimal beginning places. Following, we average per banking device together, along with the borrowing union’s integrity rating, to get the final score to your credit relationship while the a great whole. To learn more about just how Organization Insider’s private finance team ratings and you may rates banking companies, borrowing from the bank unions, and banking issues, check out the individual financing editorial criteria. As well what you need to open a bank account typically, including name, Societal Defense amount or Individual Taxpayer Character amount, and you can street address, you will have to offer information about how your meet the requirements to join the credit relationship.

Exported intangible individual assets

All of the states limit just how long the fresh property manager must get back your shelter deposit. Tend to, the new landlord are acceptance additional time if the write-offs need to be declared. When you’re condition regulations are different, they also have a lot of see here standard one thing in keeping such as the limitations about how precisely far they can costs to have public housing dumps, if they need to offer an enthusiastic itemized set of deductions, and how they should “save” your money unless you are eligible to have a deposit reimburse. We reviewed all the condition laws and regulations and you may removed out of the suggestions that you could keep an eye out to possess. When the a landlord doesn’t come back the security put and you may/or the directory of write-offs inside needed 21 days, or if the newest property manager subtracted can cost you from a protection put one to cannot had been subtracted, an occupant can be believe 3 main alternatives. One exemption are a safety put in excess of half of the brand new monthly book that has been paid ahead of 2011 to have a good device inside the Madison.

Fill out a copy of your own calculation of the New york State accumulation delivery credit and you may enter the level of the financing on the range 2. You simply can’t fool around with Function They-195 so you can authorize a direct put for the some other state’s 529 plan. To avoid almost every other charges and you can desire, pay one tax you owe from the April 15, 2025.

Book Expands for Non-Managed Leases

Preferred Rewards Precious metal having fun with a financial of The united states debit otherwise Automatic teller machine cards will never be energized the new low-Lender from The usa Atm fee and certainly will receive one to (1) refund for each and every declaration cycle of one’s Atm driver or community fee for withdrawals and you can transmits away from non-Financial of America ATMs on the You.S. If you need help obtaining house inside the Paraguay, feel free to give us a contact. Paraguay Paths specializes in bringing features regarding residency, taxation, and courtroom things in order to people out of non-MERCOSUR places. We realize exactly how challenging it could be to get accurate and you will related information regarding the new Paraguayan legal and income tax program, and you can our goal would be to clarify all of this.

Taxpayer’s permanent physical address

In such a case, the new non-resident will normally policy for the fresh Canadian vendor to get the products «drop-shipped» to the buyers in the Canada with respect to the fresh low-resident. Energy taken to airline, rail, and you will shipment companies that is actually inserted underneath the regular GST/HST program, to utilize inside the worldwide heavens, train, and you may marine transport of guests and you will cargo is actually zero-ranked. As well as, air navigation functions agreed to air companies which might be joined beneath the typical GST/HST program, to utilize on the around the world sky transportation from passengers and you may freight is zero-rated. Functions did to your temporarily imported items (apart from a good transportation provider) try no-ranked. The goods need to be typically centered outside Canada, produced for the Canada on the sole intent behind getting the provider performed in it, and really should become shipped when can be relatively be expected. Of numerous functions provided in whole, or in part, inside the Canada is actually no-rated whenever provided to a non-citizen.

Pennsylvania Leasing Direction Apps

As a result, you could potentially lender for the more regular but moderate victories instead of a great «big win otherwise chest» strategy at the Freeze Gambling enterprise. Provide a certificate for the occupant stating that all smoke sensors occur, had been examined, and therefore are inside a doing work buy only about immediately after all 12 months. The brand new landlord, their staff, otherwise a different builder could possibly get perform some assessment to determine you to definitely the brand new smoke alarm is actually a great working buy. A good. Since the included in so it part, «key» mode people actual otherwise electronic system accustomed get access to accommodations house equipment. Every piece of information try requested by the an employee or separate company from the usa to get census information pursuant in order to government law. Regarding the brand new renter, find try supported from the tenant’s history understood place of household, which may be the structure unit.

Really the only time an acknowledgment isn’t needed happens when the brand new tenant pays having a check, a note is included for the be sure it’s to have a protection put, as well as the tenant does not ask for a bill. Once you receive the returnable percentage of your defense deposit is actually ruled by the state rules, typically weeks after you escape. It’s always a good idea to deliver a safety deposit request page with your forwarding target included in the disperse-aside processes. You are requested to spend the protection put as a key part of your rent signing techniques. Very landlords today like it be paid off on the internet, thru ACH otherwise debit/mastercard percentage. Document Form They‑203‑X to help you allege your own tax reimburse reliant a keen NOL carryback.

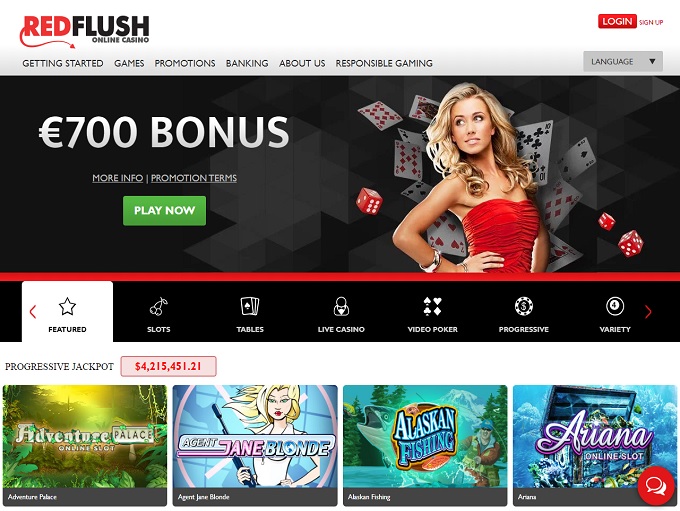

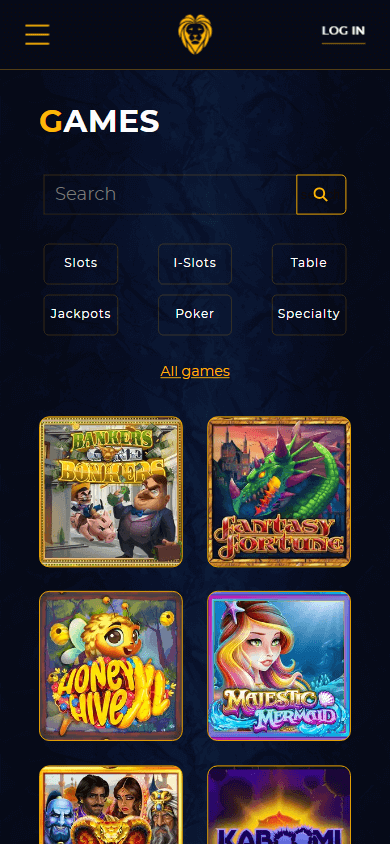

These types of now offers have been in different forms, constantly including free revolves and extra bonus finance, either since the in initial deposit fits or a zero-deposit bonus. You will need to meet up with the wagering conditions before cashing aside your own payouts, meaning you’ll want to enjoy through your added bonus finance a specific number of minutes. U.S. people can also be claim various sorts of casino incentives once they’ve produced its earliest $5 deposit. Sweepstakes casinos may also have criteria connected to purchase packages, nevertheless they typically don’t. Once you’ve picked a gambling establishment, click right through the link a lot more than to begin with the process. In the event the a plus code is necessary (come across more than in that case), enter it from the proper occupation to your registration.